In my first post, I made an assumption that people already had some sort of 401K/RRSP or TFSA/Roth IRA and were actively making trades. After speaking with some of my peers, it became evident that most did not, and the most common reasons for this were I do not have money to invest, or I have the money but do not know what to do with it, or the dreaded, my money is being managed by someone else because I don’t have the time or know how to do it myself.

I’m going to walk through how it is possible to do it yourself and you do not need to have a financial background to invest on your own.

Here are the items you need:

- Money to invest

- A brokerage firm

- List of accounts to open: RRSP, TFSA, RESP, etc.

- List of Stocks to purchase

Money to Invest

This one is pretty obvious so I won’t go into too many details on this, other than saying that investing is a cycle so there is something that you do need to do when you start investing. Some stocks offer a dividend. Basically, unless you have a good reason not to, you should make sure you reinvest any dividends back into the stock it came from. This is called a DRIP or a dividend reinvestment plan. Usually, this is automatic but worth asking at the beginning when you set up the account.

A Brokerage Firm

Now that you have the money, you need somewhere to purchase your stocks through. Pretty much every major bank will have some sort of investing arm. I live in Canada so I’m going to pick RBC bank since I currently bank with them so I can show screenshots to show how easy it is to purchase stocks.

Disclaimer: I know there are other platforms like E-Trade or Questrade and some others but I’m going to stick with a “real” bank. Here is a nice write up from Moneysense if you really want to see their ranking of the online brokerage firms in Canada.

Whether you use one of the online brokerage firms or a large bank, you need to consider all the fees associated with an account. When I started investing, TD Investing (my first brokerage firm) used to charge $125 a year to have the account and $30 a trade. Fast forward to today, as long as you have 10K in your account there is no annual fee and trades are $10 a trade or $7 if you trade a lot. The smaller online firms usually offer lower commissions on trades but they typically have different fees or make it difficult to trade in foreign currency.

Here are my HENRY reasons for using one of the major banks in Canada.

- The difference in commissions might be around $5.00. I make maybe 10 transactions a year.

- Typically there are fewer hidden fees like ECN or foreign equities fees.

- I want to keep things simple and do my banking in one place if possible

- There is some safe feeling about working with a real bank as opposed to an online outfit. Call me old fashion on this one.

- If you want to transfer money quickly, I can cut a check to my bank and have it in my trading account instantly.

- Typically less paperwork upfront since they already have your information.

What do I ask for and how do I open up an account to buy stocks?

RBC (And pretty much every other bank) allows you to open up an RRSP, TFSA, RESP, etc pretty easily. Since we want to buy stocks/equity, we need a self-directed account. TD Bank actually offers a basic self-directed account which lets you manage it yourself, but you are limited to purchasing their internal funds while a normal self-directed account allows you to do much more, so make sure you open the latter.

This is a good time to note that you can open up a self-directed account for your RRSP, TFSA and RESP. Most banks force you to make an appointment and go into the bank to sign forms so I would suggest opening up all the above accounts at once, especially if you have kids. (I’m going to have an RESP blog post soon which I will post here when ready.) Also, if you are married, bring your significant other so you can get all the additional forms filled out for power of attorney, etc. If you ask nicely sometimes only one person needs to go in and get all the paperwork, then you can bring the papers home to sign and return to the branch.

Once you open up your account, you are ready to make your first trade. Now the next logical question.

What Stocks should I put into my Portfolio

Some of you might be thinking, “Ty, you said never to buy stocks” and to those people, thank you for listening. I am a big advocate for ETFs so my recommendation for most people is to buy ETFs. Stocks and ETFs are both classified as equities so keep that in mind in case you hear that term used.

In my previous post titled: Now that I have a TFSA/RRSP, what do I invest in? I went over the reasons why ETFs are fantastic so I’m going to assume you read that post already and we are going to walk through the process of actually purchasing an ETF. (I also included the link to my favourite Podcast Freakonomics where they talk about ETFs which is a must listen to). One of the resources in the post was the Couch Potato Portfolio which is the technique I’ve used for the past 10+ years. In the next section, I’ll show you how I purchase equities using RBC.

Walkthrough of RBC Direct Investing

As I mentioned earlier, I bank through RBC, so here are the steps I take, to purchase an equity. Most banks have a similar process so this can be used as a proxy for whichever bank you happen to use. RBC is has a pretty dated UI so if that is something important to you, I found that TD’s investing platform a little easier on the eyes.

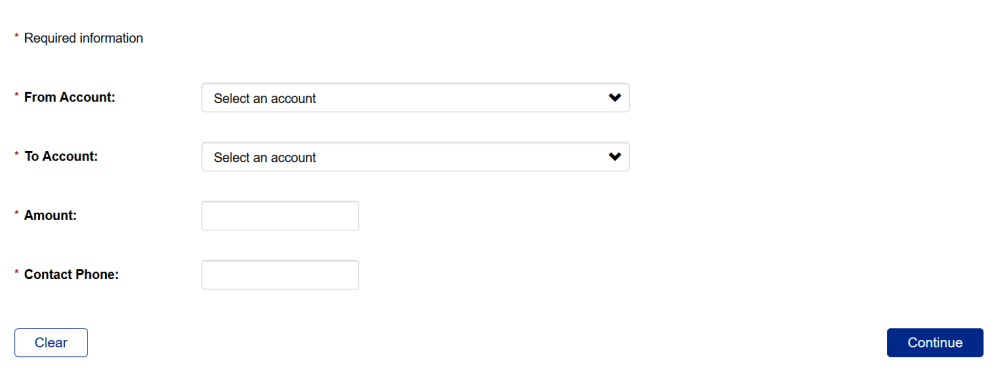

Step 1. Transfer money from your bank account to your trading account.

Pretty straightforward. As I mentioned, one nice thing about a real bank is that you can transfer money quickly. It’s February 11th today, and in Canada the RRSP deadline is March 1st this year so in the next couple of weeks, there will be a lot of people at the banks trying to meet this deadline, so if you are a procrastinator, this is another plus for one of the big banks.

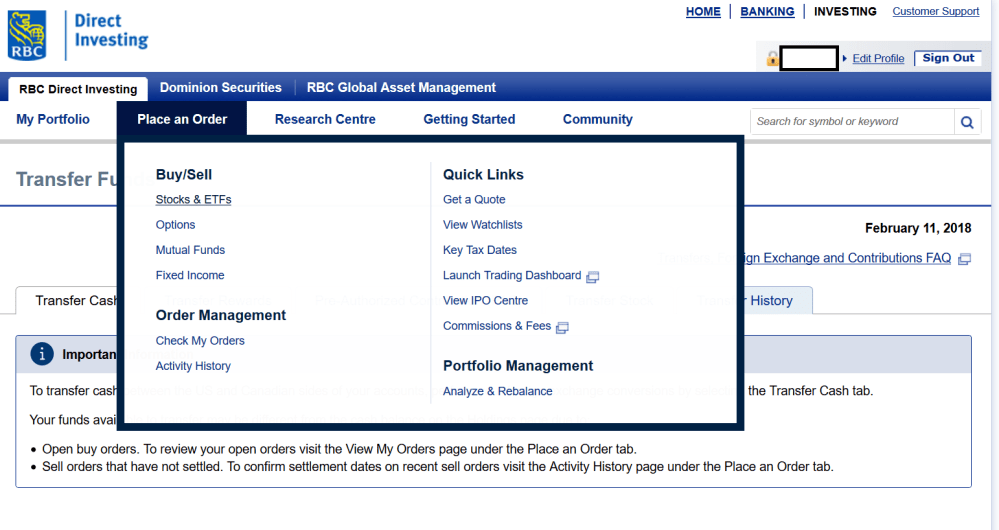

Step 2. Once the money is in the account, initiate a trade

On RBC even though stocks and ETFs are essentially both equities, they put both in the description.

Step 3. Pick your account and pick your ETF

If you have multiple accounts, you can pick it from here. RBC creates two accounts per account, one for USD and one for CAD. This is nice because, with other banks, when you sell a US equity, it would automatically convert it to CAD. This is not good as you end up paying a higher exchange rate than the spot rate and it’s nice to have US cash for when you want to purchase another US equity.

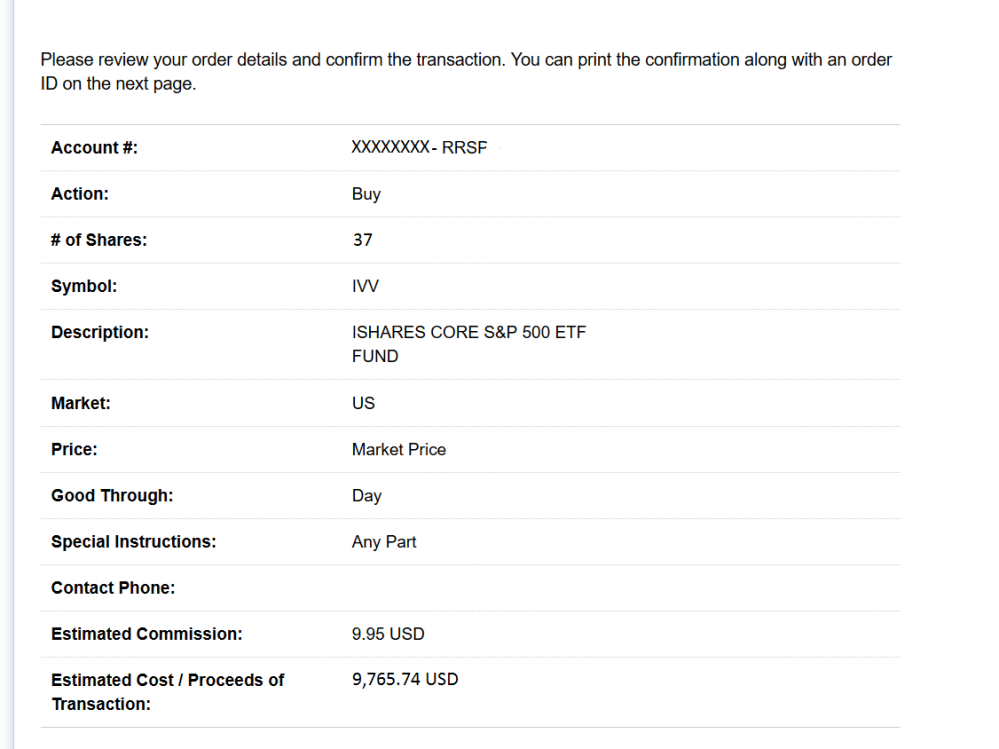

I’ve selected iShares IVV as the ETF to purchase for this example. This is actually one of my favourite ETFs as has a ridiculously low expense ratio of 0.04%. It’s a US equity so US Market is selected and clicking refresh quote shows the current price for the equity.

Step 3. How many shares do I buy?

ETFs typically range in price from $10-$20. IVV is fairly high at $264, but the price of the ETF is really irrelevant for two reasons. In general, the stock price is only one piece of the puzzle, the number of outstanding shares is needed to know the true value of the company. Secondly, since we really care about % returns, the actual price is less important.

RBC and most banks usually offer a little calculator to figure out how many shares you can purchase given a certain amount to invest. In this example, I have 10KUSD to invest and the current stock price is $263.67. The calculator tells me, I can purchase 37 shares @263.67 for a total of $9765.74USD.

Step 4. Fill in the numbers for the order

Once we know we can purchase 37 shares, we go back to the order screen and fill in the numbers. A few key things to consider at this point.

Here’s a summary of the terms and what we will fill in.

Account #: Select the appropriate account and currency. Note, you can actually select your CAD account to purchase US equities and vice versa.

Action: Buy/Sell – buy, in this case.

# of Shares: This has been calculated to be 37.

Symbol: Stock ticker – IVV, in this case, Market: US or CAN, US, in this case.

Price: Market price/Limit – The market price is the current price. The limit price is used if for example, you only want to buy IVV if it goes below $260USD. In this case, when you place the order, it will only trigger if the bid price goes below $260USD. I will choose market price since I just want to buy the ETF at its current price.

Good Through: Day/Specified – This is only an option if you select limit above. You can typically set up to 1 month for the order to be active. After that period, it expires.

Special Instructions: Any part/All or None. Not really relevant since the trade size is small but, technically if you bought enough shares, it could take a few transactions for your entire order to go through so you have the option to wait for one large transaction or partials. Typically these are done by the 100s.

Step 5. Submit the order.

Once you hit okay on the previous screen, you will go to a summary page with the following information. Sometimes, you will get warnings or errors on this page if you do not have enough money in your account or if based on the exchange rate, you might not have enough to cover the FX charges.

Interesting note on exchange rates at RBC. Some banks charge different rates to change currencies based on the amount you are changing. Usually, this is in 5K increments so the larger the better. RBC, charges a flat rate which ends up being pretty close to the spot rate. I’m not too picky about this as I don’t exchange currency back and forth often enough that this would be an issue. If you want to trade currencies, then some of the online platforms will have smaller spreads on this.

If all the information is correct, hitting confirm, submits the order. At this point, if you picked market price above, the order cannot be changed. If you picked a limit price, you can always go back and edit your order as long as the limit price hasn’t been reached.

Step 6. Repeat and Watch your money Grow

Once you purchase your first ETF, you can pick out a few more. I would recommend one of the portfolios in the Couch Potato portfolio and buy the ETFs they recommend. They can be found here.

The beauty of this system is that you only really need to do maintenance on your portfolio, once a year. At the end of the year, some of your ETFs will grow faster than the other ones. For example, if you held two ETFs and both you invested 10K into at the beginning of the year, if one is at 12K and one is at 11K and you have 20K to invest at the end of the year, I would put 9.5K into the first and 10.5K into the second. Both will now have 21.5K in them. You are basically selling high and buying low at the same time.

You could invest more often throughout the year, which actually is better than investing once a year, but the commission fees do add up. My general rule of thumb is I like my transactions to be between 5-10K minimum.

In conclusion

Hopefully, this information was useful and showed how easy it can be to open up and buy stocks without the help or a financial advisor. If you have any questions at all, please feel free to comment below or send me a private message. Thanks as always for reading.

Bonus Section

A friend of mine asked if I could pick out some of my favourite ETFs and post them here. In a way, this is counter-intuitive since how can you have a favourite ETF, aren’t they all the same? This is partially true as an ETF of the S&P500 from iShares or Vanguard should be the same, but there are some small differences based on fees or currency so here are my top picks and if I had to build a portfolio today from scratch for the average 30 something-year-old with 50K to invest.

10k (20%) into IVV or XUU. Both are S&P500 ETFs with IVV being in USD and XUU being in CAD. Both offer very good total fees at 0.04% and 0.14% respectively.

10k (20%) into XIC. This is a Canadian TSX composite ETF. Total fees of 0.11%.

10K (20%) into XQQ. This is a Canadian hedged Nasdaq ETF. A good way to get exposure to technology stocks without purchasing individual stocks. This ETF returned 36% last year in 2017. Total fees of 0.71%.

7.5K (15%) into IEFA. This is a non-US/Canada world Index ETF. It’s in USD and the total fees are 0.08%.

7.5K (15%) into MSCI. This is an emerging market index ETF. It’s in USD and the total fees are 0.14%.

Finally 5k (10%) into XQB. This is a nice safe Canadian Bond Index ETF. No huge returns but no huge risk either. This percentage of the portfolio is pretty small. As you grow older this percentage should increase as your appetite for risk decreases. Total fees of 0.12%. If you want a little more risk, I also like XFN. This is a Canadian Banks ETF so it gives you the benefit of being pretty safe but with some upside as well. Total fees of 1.16%.

One thought on “How to: Buy Stocks the easy way”